Ad Compare Live Annuity Rates From Over 25 Top Companies. Ad Our Income Annuity Calculator Can Help You Plan For The Future.

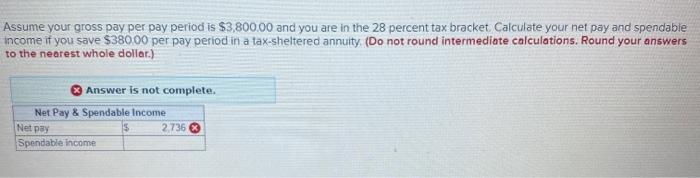

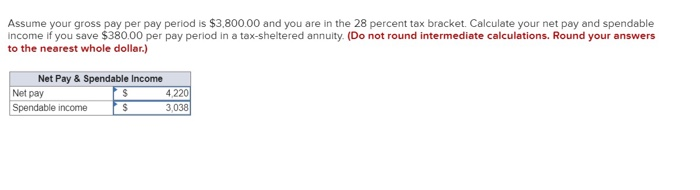

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

With this calculator you can find several things.

. Learn some startling facts. We Offer Innovative Products For Retirement That Help You Keep Your Plans. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

Annuities are often complex retirement investment products. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Ad Search For Info About Annuity calculator.

The contributions are deducted from the. The IRS Withholding Calculator IRSgovW4App. In this publication you will find information to help you do the.

A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Click Play to Play the Hero Carousel Content Click Pause to Pause the Hero Carousel Content.

This publication can help you better understand the tax rules that apply to your 403 b tax-sheltered annuity plan. Annuity Contract Holders Get answers to questions. Dear Allen If you were born before Jan.

Do Your Investments Align with Your Goals. No Phone Number Required. Ad Learn More about How Annuities Work from Fidelity.

It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. Earnings in annuities grow and compound tax.

Ad Learn More about How Annuities Work from Fidelity. When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities. The payment that would deplete the fund.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. Browse Get Results Instantly. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities.

The most common tax-sheltered investments. A tax-sheltered annuity is a special annuity plan or contract purchased for an employee of a public school or tax-exempt organization. Tax-sheltered annuities TSA are retirement plans that provide a tax-sheltered method of saving allowing the employees to make elective deferral contributions on a tax-deferred basis.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. A Fixed Annuity can provide a very secure tax-deferred investment. If youre interested in buying an annuity or selling your annuity or structured settlement payments we will connect you with.

Find a Dedicated Financial Advisor Now. If you withdraw money from your. Report income tax withholding from pensions annuities and governmental Internal Revenue Code section 457 b plans on Form 945 Annual Return of Withheld Federal Income Tax.

Just type in the keywords annuity calculator in the search engine. The terms tax-sheltered annuity and 403b are often used interchangeably. You are only taxed on the.

Ad True Investor Returns With No Risk. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. IRC 403 b Tax-Sheltered Annuity Plans.

Learn More on AARP. A tax-sheltered annuity TSA allows an employee to make contributions from his income into a retirement plan. New Look At Your Financial Strategy.

A tax-sheltered annuity plan gives employees. If you want to know more about the tax status of annuities you may also use a free online calculator. An annuity is an investment that provides a series of payments in exchange for an initial lump sum.

Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. 501c 3 Corps including colleges universities schools. FindInfoOnline Can Help You Find Multiples Results Within Seconds.

Visit The Official Edward Jones Site. A 403b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well. Calculate your earnings and more.

Find Out How With Our Free Report Get Facts. 403 b plans are only available for employees of certain non-profit tax-exempt organizations.

Taxable Income Formula Calculator Examples With Excel Template

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Taxation How Various Annuities Are Taxed

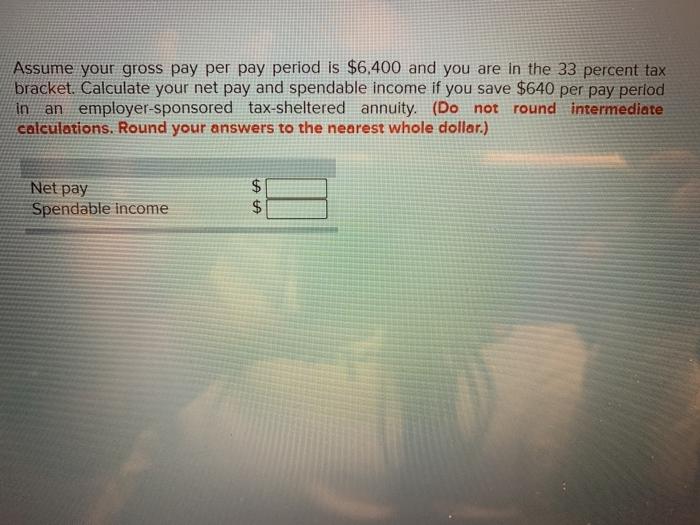

Solved Assume Your Gross Pay Per Pay Period Is 6 400 And Chegg Com

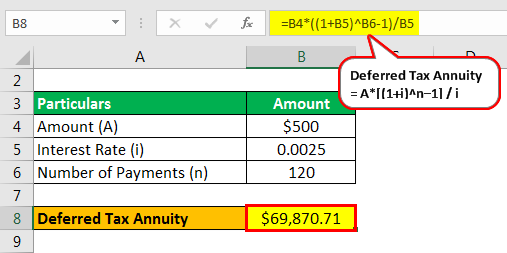

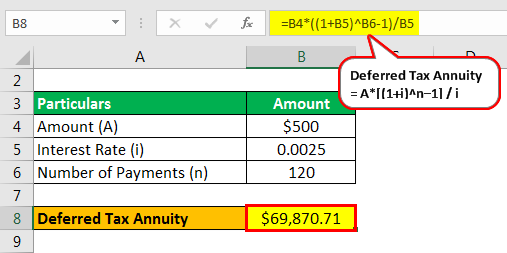

Tax Deferred Annuity Definition Formula Examples With Calculations

The Best Annuity Calculator 17 Retirement Planning Tools

The Best Annuity Calculator 17 Retirement Planning Tools

Annuity Investment Calculator Investment Annuity Calculator

What You Should Know About Tax Sheltered Annuities The Motley Fool

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

The Tax Sheltered Annuity Tsa 403 B Plan

Tax Deferred Annuity Definition Formula Examples With Calculations

What Is An Annuity And How Do You Calculate It Quora

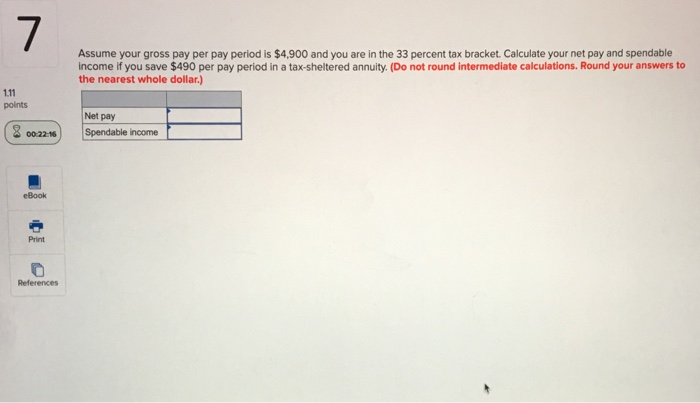

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com

Obamacare Investment Tax Problem For High Income Earners

The Best Annuity Calculator 17 Retirement Planning Tools

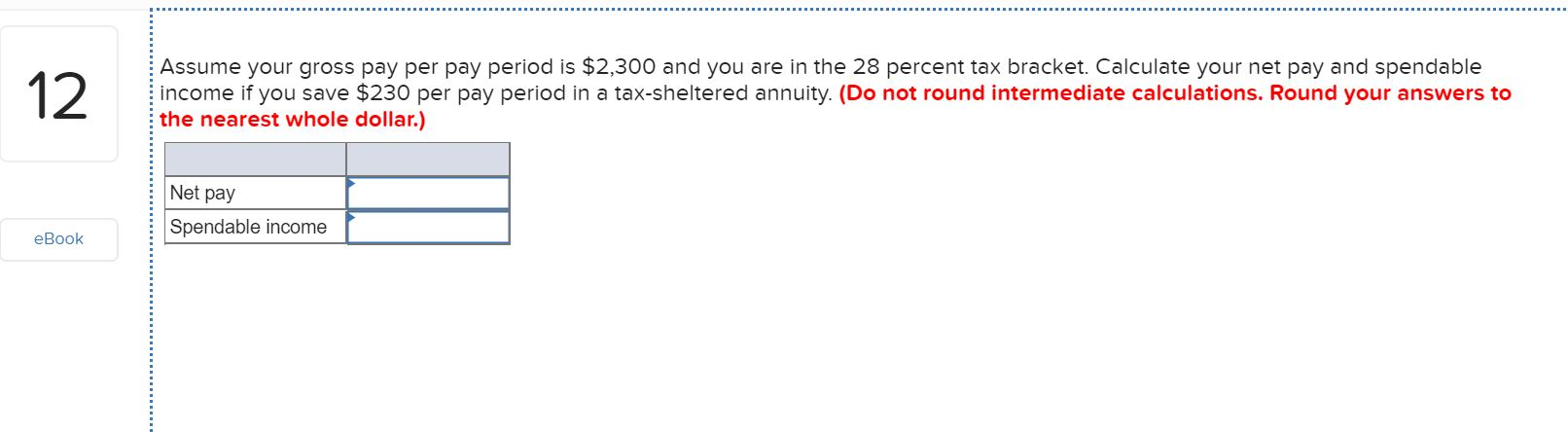

Solved 12 Assume Your Gross Pay Per Pay Period Is 2 300 And Chegg Com

Tax Deferred Annuity Definition Formula Examples With Calculations